Liquidity pools are a key part of decentralized finance (DeFi). These smart contract-powered token collections have changed how we think about market-making and trading assets. Liquidity pools allow for decentralized and automated liquidity provision. They’re now central to many DeFi protocols, enabling everything from basic token swaps to complex yield farming. Let’s explore liquidity pools and how they impact the cryptocurrency world.

Key Takeaways

- Liquidity pools are essential for decentralized exchanges and DeFi protocols

- They use smart contracts and automated market maker (AMM) algorithms

- Participants can earn passive income through trading fees and yield farming

- Risks include impermanent loss and smart contract vulnerabilities

- Popular platforms include Uniswap, Curve Finance, and Balancer

- The future of liquidity pools includes cross-chain solutions and improved risk management

What Are Liquidity Pools?

Liquidity pools are collections of cryptocurrencies or tokens locked in smart contracts. They’re the backbone of decentralized exchanges (DEXs), letting users trade digital assets without relying on traditional order books or middlemen. These pools represent a big change in how liquidity is provided and managed in financial markets. Instead of centralized market makers, now anyone can help provide liquidity.

Liquidity pools solve the traditional problem of market liquidity by letting users put assets directly into a shared pool. This new approach has several key benefits:

- More market liquidity: By pooling resources from many participants, liquidity pools create deeper markets for various token pairs, reducing slippage and improving trades.

- Less trading slippage: The constant availability of liquidity means that even big trades can happen with minimal price impact, helping traders of all sizes.

- 24/7 trading: Unlike traditional markets with set hours, liquidity pools allow round-the-clock trading, matching the always-on nature of cryptocurrencies.

- Decentralized financial services: Liquidity pools let individuals become market makers, opening up financial services and income streams that were once only for big institutions.

- Programmable liquidity: Smart contracts governing these pools can be customized to create new financial products and services, encouraging innovation in DeFi.

How Do Liquidity Pools Work?

At their core, liquidity pools use smart contracts and automated market maker (AMM) algorithms. These systems automate price discovery and trade execution, removing the need for traditional order books. Here’s how it works:

- Liquidity providers put equal values of two tokens into a pool: This sets the starting balance and price ratio for the token pair.

- They get liquidity provider (LP) tokens for their share: These tokens represent their claim on the pool’s assets and fees, making it easy to join or leave the pool.

- Traders can swap tokens directly with the pool: Instead of matching buy and sell orders, users trade against the pool’s liquidity, ensuring quick trades.

- AMM algorithms adjust prices based on the ratio of tokens in the pool: As trades happen, the algorithm keeps a constant product of token quantities, adjusting prices to reflect supply and demand.

- Trading fees are shared among liquidity providers: This encourages liquidity provision and creates a passive income stream for participants.

- Arbitrageurs help keep prices balanced: By taking advantage of price differences between pools and other markets, arbitrageurs help keep pool prices in line with broader market rates.

Benefits for Liquidity Providers

Joining liquidity pools can be a good way for cryptocurrency holders to make money from their assets. By becoming a liquidity provider, you can:

- Earn passive income through trading fees: As people use the pool to trade, you get a share of the fees based on how much you’ve put in.

- Join yield farming and liquidity mining programs: Many protocols offer extra token rewards to liquidity providers, potentially increasing your returns.

- Help grow decentralized finance: By providing liquidity, you’re supporting the health and efficiency of the DeFi ecosystem.

- Get exposure to multiple assets: Providing liquidity to a pool lets you maintain a balanced position in two or more tokens at once.

- Try new investment strategies: LP tokens can often be used as collateral in other DeFi protocols, opening up more ways to earn.

But it’s important to understand the risks, like impermanent loss and potential smart contract problems. Impermanent loss happens when the price ratio of the tokens in a pool changes, which could mean you end up with less value than if you’d just held the assets. Smart contract risks, while reduced through audits and best practices, can still be a threat to funds if exploited.

Popular Liquidity Pool Platforms

Several decentralized exchanges have become popular for their innovative liquidity pool designs, each with unique features:

- Uniswap: Known for its simple interface and wide range of token pairs, Uniswap pioneered automated market makers in DeFi. It uses a constant product formula (x * y = k) to set token prices and has become a standard for DEX design.

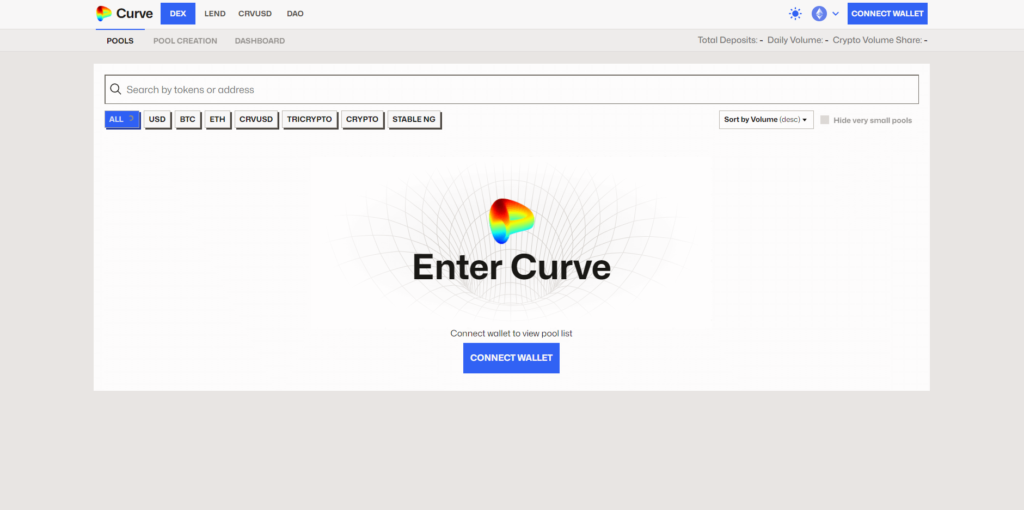

- Curve Finance: Specializes in stablecoin swaps with low slippage, using a unique algorithm optimized for assets that should trade at nearly the same price. This makes it very efficient for trading between different stablecoins or wrapped versions of the same asset.

- Balancer: Offers customizable multi-token pools, allowing for more complex portfolio management strategies. Balancer’s flexibility lets liquidity providers create pools with up to eight different tokens in various weightings.

- SushiSwap: A fork of Uniswap that added features like yield farming and governance tokens, aiming to create a more community-driven platform.

- PancakeSwap: Built on the Binance Smart Chain, PancakeSwap offers lower fees and faster transactions compared to Ethereum-based DEXs, though with potential trade-offs in decentralization.

Risks and Considerations

While liquidity pools offer exciting opportunities, it’s important to know the potential risks and challenges of participating in these protocols:

Common Risks in Liquidity Pools

- Impermanent Loss

- Smart Contract Vulnerabilities

- Market Volatility

- Regulatory Uncertainty

Always do your research and maybe talk to a financial advisor before joining liquidity pools or any DeFi activities. It’s important to understand how each pool works, including fees, token economics, and potential impermanent loss scenarios. Also, consider these risk management strategies:

- Diversification: Spread your investments across different pools and platforms to reduce risk from any single point of failure.

- Regular monitoring: Keep an eye on your positions and be ready to change your strategy based on market conditions and how the pool is performing.

- Use of risk management tools: Some platforms offer protection against impermanent loss or insurance options, which can help reduce potential losses.

- Stay informed: Keep up with the latest news in DeFi and the specific protocols you’re using to make good decisions.

The Future of Liquidity Pools

As DeFi keeps growing, we can expect to see more innovations in liquidity pool technology. Some emerging trends and potential developments include:

- Cross-chain liquidity solutions: Protocols that allow easy liquidity provision and trading across different blockchain networks, improving interoperability and capital efficiency.

- Better impermanent loss protection: Advanced algorithms and insurance-like products designed to reduce or compensate for impermanent loss risks.

- Integration with traditional finance: Bridges between DeFi liquidity pools and traditional financial markets, potentially bringing in more liquidity and mainstream adoption.

- Layer 2 scaling solutions: Implementing liquidity pools on layer 2 networks to reduce fees and increase transaction speed, making it easier for more people to participate.

- AI-driven pool management: Using artificial intelligence to optimize pool settings, rebalancing strategies, and risk management in real-time.

- Regulatory compliance features: Developing KYC/AML-compliant liquidity pools to allow institutional participation and navigate changing regulations.

Conclusion

Liquidity pools are changing finance, offering new opportunities for traders, investors, and developers. By understanding how they work and staying informed about new developments, you can make the most of this exciting technology in decentralized finance. As the technology improves, we might see liquidity pools become an important part of both decentralized and traditional financial systems, potentially changing how we think about market making, asset management, and financial inclusion.

Whether you’re experienced in DeFi or just starting, liquidity pools offer an interesting look at the future of finance. By using smart contracts and community-driven liquidity, these innovative systems are creating a more open, efficient, and accessible financial world. Liquidity pools could be used for more than just token swaps in the future, with possibilities in lending, borrowing, derivatives, and even tokenizing real-world assets.

Remember to always do your research, start small, and never invest more than you can afford to lose. The world of DeFi is full of possibilities, and liquidity pools are just the beginning. As you explore these opportunities, think about not just the potential financial benefits, but also how your participation helps build a more inclusive and decentralized financial system. The future of finance is being created now, and liquidity pools are at the forefront of this change.