Automated Market Makers (AMMs) are changing how cryptocurrency trading works. These smart contract systems let anyone with a crypto wallet take part in trading. AMMs are making decentralized finance (DeFi) more open and easy to use. They offer a new way to exchange digital assets that’s more accessible and clear. Let’s look at how AMMs work and why they’re important for DeFi.

Key Takeaways:

- AMMs use smart contracts and liquidity pools for decentralized trading

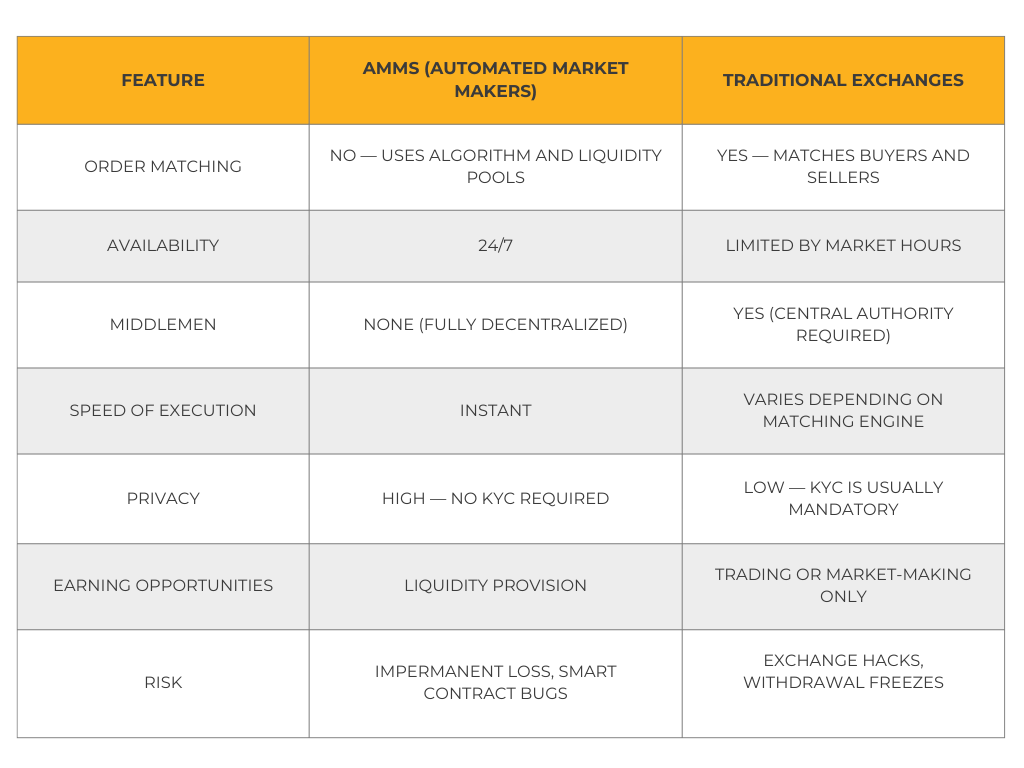

- They don’t need traditional order books or middlemen

- AMMs allow 24/7 trading and can earn you money by providing liquidity

- Popular platforms include Uniswap, Curve Finance, and Balancer

- AMMs have benefits but also risks like impermanent loss

- Future AMMs might include features like concentrated liquidity and cross-chain trading

What Are Automated Market Makers?

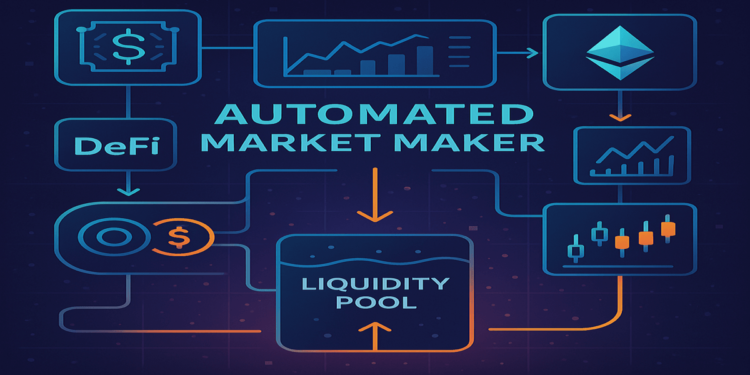

AMMs are computer programs that change how cryptocurrency trading works. Unlike regular exchanges that match buyers and sellers, AMMs use math and token pools to set prices and make trades happen automatically. This new way of doing things doesn’t need middlemen and makes trading easier for everyone.

Most AMMs use a formula called “constant product,” which looks like x * y = k. In this formula, x and y are the amounts of two different tokens in a pool, and k stays the same no matter what. This math helps keep prices steady and makes sure there’s always enough tokens to trade, even when the market is crazy.

How Do AMMs Work?

AMMs use liquidity pools, which are big collections of cryptocurrency tokens. People called liquidity providers put their tokens in these pools to help with trading. When someone wants to trade one token for another, they don’t need to find another person to trade with. Instead, they trade directly with these pools of tokens.

How AMMs Work

- Users deposit tokens into liquidity pools, becoming liquidity providers

- Smart contracts manage these pools, enforcing trading rules and calculations

- Traders swap tokens directly with the pool, not with other individuals

- Prices adjust automatically based on the changing ratios of tokens in the pool

- Liquidity providers earn fees from trades, proportional to their pool share

One cool thing about AMMs is that anyone can join in. If you have cryptocurrency, you can become a liquidity provider by putting your tokens in a pool. This helps the DeFi system and can earn you money. When people use the pool to trade, liquidity providers get a share of the fees. This way, everyone can be like a mini market maker, not just big companies.

Popular AMM Platforms

There are several well-known AMM platforms in DeFi, each with its special features:

Uniswap

Pioneer of AMMs, uses constant product formula for trading

Curve Finance

Specialized for stablecoin swaps with low slippage

Balancer

Supports multi-asset pools with custom ratios

Decentralized exchanges that use AMMs have made it much easier for people to trade cryptocurrency. These platforms work all the time, so you can trade whenever you want from anywhere with internet. This has helped DeFi grow fast.

Benefits of AMMs

AMMs have many advantages over old-style exchanges, which is why they’re becoming so popular:

- No need to match orders: AMMs let you trade instantly without waiting for someone else to buy or sell.

- Always open: Unlike regular markets that close, AMM exchanges are open 24/7.

- Cheaper: Many AMMs have lower fees than centralized exchanges, so trading costs less.

- Anyone can provide liquidity: You can add your tokens to a pool and earn fees, giving you a new way to make money.

- More private: AMMs often don’t need you to create an account or prove who you are, so you can stay more anonymous.

- Easy to add new tokens: New cryptocurrencies can be added to AMMs quickly, without a long process.

- Better market efficiency: AMMs can provide liquidity for many different tokens, even ones that aren’t traded much.

These benefits have helped DeFi grow a lot in recent years. AMMs have made it easier for new projects to start and for people to trade many different tokens, which has led to more innovation in the cryptocurrency world.

Challenges and Risks

While AMMs are great in many ways, they also have some challenges and risks you should know about:

- Impermanent loss: This happens when the price of tokens in a pool changes, which can cause losses for liquidity providers.

- Smart contract problems: AMMs use smart contracts, which might have bugs that could put your money at risk if someone exploits them.

- Slippage: Big trades can change token prices a lot in AMM pools, especially for less popular token pairs.

- Front-running: Some traders might try to cheat the system by getting their trades in first, which isn’t fair to others.

- Unclear rules: Laws about DeFi and AMMs are still being figured out, which could cause problems in the future.

- Complicated for beginners: AMMs can be hard to understand if you’re new, which might lead to mistakes.

It’s important to learn about these risks before you start using AMMs or becoming a liquidity provider. Like with any cryptocurrency investment, don’t put in more money than you can afford to lose, and be careful.

The Future of AMMs

AMMs are changing fast, with new ideas to make them better:

- Concentrated liquidity: This lets liquidity providers focus their tokens in specific price ranges, which could make trading more efficient.

- Cross-chain AMMs: These could let you trade tokens between different blockchains, making decentralized trading even bigger.

- Layer 2 solutions: These could make transactions cheaper and faster on AMMs.

- AI integration: Smart computer programs might help make AMMs work better and find better prices.

- New token systems: People are working on better ways to reward liquidity providers and govern AMMs.

- More privacy: New technology might make AMMs more private and secure.

- Tools for following rules: As laws change, AMMs might add features to help users follow the rules while staying decentralized.

These new developments could make AMMs even more powerful and useful, helping decentralized finance grow even more around the world.

Conclusion

Automated Market Makers have changed cryptocurrency trading in a big way. They’ve made it possible for anyone to trade without middlemen, opening up new opportunities for traders, investors, and entrepreneurs. AMMs are helping create a more open and accessible financial system.

As AMMs keep improving, they’ll likely become even more important in decentralized finance. Innovations will fix current problems, make AMMs easier to use, and create new ways for people to use digital money. Whether you’re experienced with crypto or just starting, understanding AMMs is key to navigating the exciting world of DeFi.

As you explore AMMs and think about trading or providing liquidity, it’s really important to keep your digital assets safe. Using a good hardware wallet like the Ledger Flex can help protect your cryptocurrencies. By combining the exciting potential of AMMs with strong security practices, you can confidently explore decentralized finance while keeping your investments safe.

FAQ Section

What is an Automated Market Maker (AMM)?

An AMM is a smart contract-powered system that allows users to trade cryptocurrencies directly with a liquidity pool instead of using a traditional order book. It automatically sets token prices using a mathematical formula.

How do AMMs work in DeFi?

Can I earn passive income with AMMs?

What are the risks of using AMMs?

Risks include impermanent loss, smart contract bugs, front-running, slippage, and regulatory uncertainty. Always do your research before investing or providing liquidity.

What is impermanent loss?

Impermanent loss occurs when the price of tokens in a liquidity pool changes compared to when you deposited them. If you withdraw your tokens after a large price swing, you might end up with less value than if you simply held them.