Cryptocurrency markets are known for their big swings. If you’re new to digital money, you’ve probably heard about “bull markets” and “bear markets.” Let’s break down what these animal-inspired terms mean and how they affect your investments.

| Key Takeaways | |

|---|---|

| Bull Market | Rising prices, high confidence, increased trading volume |

| Bear Market | Falling prices, low confidence, decreased trading activity |

| Duration | Bull markets typically last 2-3 years, bear markets about 1 year |

| Influencing Factors | Regulations, adoption, technology advancements, economic conditions |

| Investment Strategies | Vary based on market conditions and individual risk tolerance |

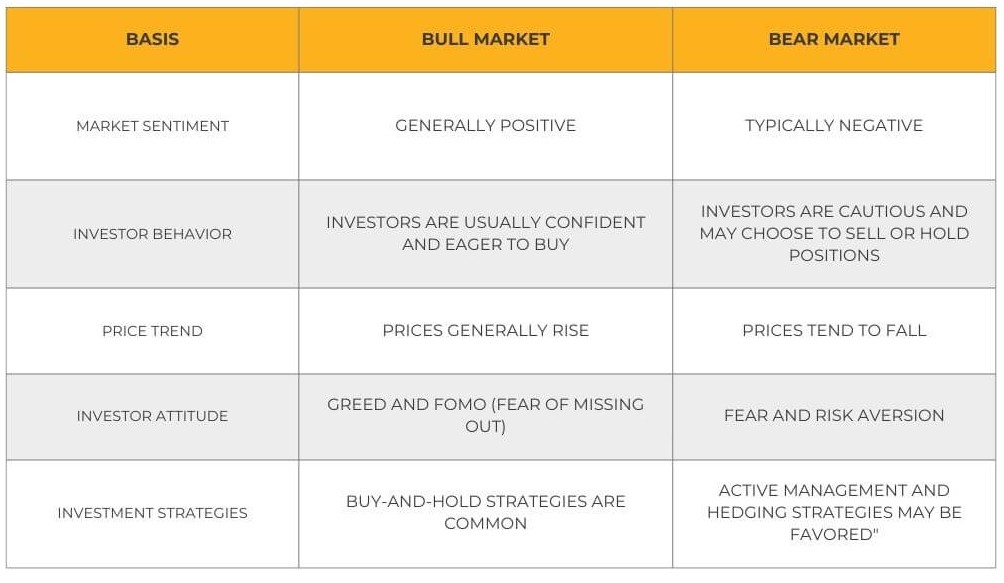

What Are Bull and Bear Markets?

In the crypto world, bull and bear markets describe how the market is doing overall. It’s like the mood of the market:

A bull market is when prices are going up, and everyone’s feeling good about investing. It’s like the market is charging forward, just like a bull would. A bear market is when prices are falling, and people are worried about investing. It’s like the market is hiding, just like a bear might do. Understanding these cycles is important for making smart investment choices.

How Long Do These Markets Last?

Crypto markets move faster than regular stock markets. They’re open 24/7 and can be more extreme. Here’s what we usually see:

- A typical crypto bull market might last around 2-3 years, with prices going up overall.

- Bear markets in crypto usually last about 1 year, but can feel much longer!

Remember, these are just averages. The crypto world is still new, and things can change quickly. That’s why it’s important to understand the key terms and keep learning about how markets work.

What Causes Bull and Bear Markets?

Lots of things can make the crypto market go up or down:

- News about regulations or laws

- Big companies or countries accepting (or rejecting) cryptocurrencies

- New technology or improvements in how cryptocurrencies work

- What’s happening in the regular economy (like inflation or recessions)

- How people feel about the market (called “market sentiment”)

Sometimes, it’s just about how people feel. If everyone thinks prices will go up, they might buy more, which can actually make prices go up. Understanding these things can help you make better choices when investing.

How to Spot a Bull or Bear Market

Figuring out if we’re in a bull or bear market isn’t always easy, but here are some signs to look for:

Bull Market Signs:

- Prices are going up steadily over time

- More people are talking about crypto in a positive way

- You see more news about new crypto projects and investments

- More people are buying and selling crypto

Bear Market Signs:

- Prices are falling and staying low for a while

- You hear more negative news about crypto

- Fewer new projects are starting up

- People aren’t buying and selling as much crypto

If you want to get better at spotting these trends, check out our cryptocurrency trading guide for more tips.

What Should You Do in Different Markets?

Your strategy might change depending on whether we’re in a bull or bear market:

In a Bull Market:

- Some people like to buy and hold, hoping prices will keep going up

- Others might take some profits by selling a bit of what they have

- It’s a good time to learn about new projects that are popping up

In a Bear Market:

- Some investors see this as a chance to buy cryptocurrencies at lower prices

- It’s a good time to learn more and do research for when prices go up again

- Many people focus on saving and being careful with their money

No matter what the market is doing, it’s always smart to learn about ways to earn passive income with crypto. This can help you handle the ups and downs better.

The Emotional Side of Markets

One of the trickiest parts of crypto investing is dealing with your feelings. In a bull market, it’s easy to get too excited and make risky choices. In a bear market, fear can make you sell when you shouldn’t. Learning to control your emotions is super important for long-term success in cryptocurrency investing.

Beyond Bitcoin: Altcoins in Bull and Bear Markets

While Bitcoin is the most famous cryptocurrency, there are thousands of others called “altcoins.” These can act differently in bull and bear markets:

- In bull markets, some altcoins might grow even faster than Bitcoin

- In bear markets, many altcoins can lose value quicker than Bitcoin

- Different altcoins can do well or poorly based on their specific features and uses

If you’re curious about different types of cryptocurrencies, you might want to learn about meme coins, which are a special kind of altcoin that can be extra risky but sometimes very rewarding.

The Future of Crypto Markets

As cryptocurrency becomes more common, some people think the markets might become more stable. Here’s what many experts are watching:

- How governments around the world decide to regulate crypto

- Whether more big companies start using or accepting cryptocurrencies

- New technologies that could make cryptocurrencies faster or more useful

- How decentralized finance (DeFi) might change traditional banking

- The impact of central bank digital currencies (CBDCs) on the crypto market

No one can predict the future for sure, but learning about these trends can help you make better choices. If you want to learn more about new crypto technologies, check out how liquidity pools in DeFi are changing things for many crypto investors.

Wrapping Up: Your Crypto Journey

Understanding bull and bear markets is just the start of your crypto adventure. Here are some final tips to help you on your journey:

- Do your research before investing

- Start small and learn as you go

- Keep an eye on the big picture, not just daily price changes

- Be ready for both exciting highs and tough lows

- Keep learning about new developments in crypto

- Think about how taxes might affect your crypto investments

- Always prioritize security when dealing with crypto

Whether the market is up or down, the most important thing is to keep learning. For more tips on growing your crypto investments, check out staking in DeFi as a way to earn passive income. Happy investing!

What is a Bull Market in Crypto?

A bull market in crypto is when prices rise steadily, investor confidence is high, and trading volume increases.

What is a Bear Market in Crypto?

A bear market in crypto is when prices decline, investors lose confidence, and trading activity decreases.