As we approach mid-2025, people are wondering if Bitcoin will reach a new record high price. In this article, we’ll examine seven important indicators that can help us guess if Bitcoin will soon reach a new record. These indicators are useful for both experienced traders and people new to cryptocurrencies. Understanding them can help you make smarter choices about buying or selling Bitcoin.

Key Points

- Bitcoin’s current all-time high is $109,358, set on January 20, 2025

- Bitcoin All-Time High in 2025? 7 Crucial Indicators to Watch

- On-chain data, technical analysis, and macro trends all play a role

- Monitoring these indicators can help predict potential price movements

- Institutional adoption and regulatory developments are crucial factors

1. On-Chain Data: Looking at the Blockchain

On-chain data shows us what’s happening on the Bitcoin network. It’s like looking at Bitcoin’s health from the inside. Here are three important things to watch:

a) HODL Waves

HODL waves show how long people have been holding their Bitcoin. When more people hold for a long time, it often means the price might go up. Right now, we’re seeing more people holding Bitcoin for over a year, which could be a good sign.

b) Exchange Inflows and Outflows

This looks at how much Bitcoin is moving in and out of exchanges. When more Bitcoin leaves exchanges, it often means people are planning to keep it for a while, which can be good for the price. Recently, more Bitcoin has been leaving exchanges than coming in, which might mean the price could go up.

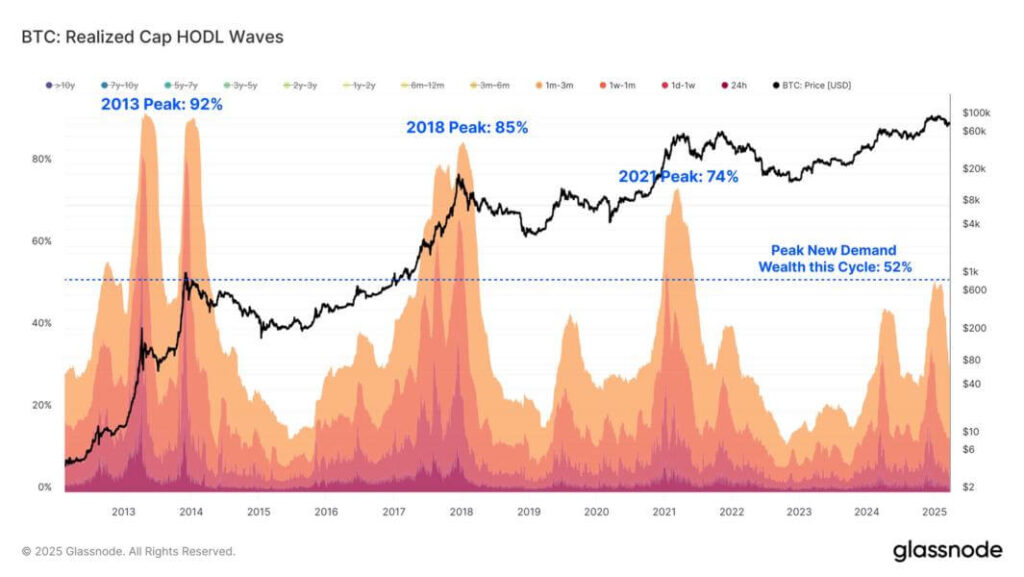

c) Realized Cap HODL Waves

This fancy-sounding indicator helps us determine whether Bitcoin is too expensive or too cheap. Right now, it shows that Bitcoin might be at a good price to start going up more.

Understanding these on-chain metrics is important, especially as we approach the next Bitcoin halving. The halving is when the new Bitcoin made each day is cut in half, which has caused the price to go up in the past.

2. Technical Analysis: Looking at Charts

Technical analysis is like reading a map of Bitcoin’s price. It helps us guess where the price might go next. Here are some things to look at:

a) Moving Averages and Golden Cross

Moving averages smooth out Bitcoin’s price chart to show the trend. A “Golden Cross” is a bullish chart pattern that occurs when a short-term moving average (MA), typically the 50-day MA, crosses above a longer-term moving average, often the 200-day MA. This crossover suggests that a security’s upward momentum is gaining strength, indicating that a longer-term uptrend may be underway.

b) Relative Strength Index (RSI)

The RSI shows if Bitcoin might be getting too expensive or too cheap. Right now, it’s in the middle, which means Bitcoin’s price could still go up more before it gets too expensive.

c) Fibonacci Retracement Levels

These are special lines on the chart that show where Bitcoin’s price might stop going down or up. Watching these levels can help you decide when to buy or sell.

3. Market Sentiment: How People Feel About Bitcoin

How people feel about Bitcoin can affect its price. We can look at social media and other indicators to see what people think:

a) Google Trends and Search Volume

When more people search for Bitcoin on Google, it often means more people are interested in buying it. Searches for Bitcoin have been going up slowly, which could be a good sign.

b) Social Media Mentions and Engagement

Looking at how much people talk about Bitcoin on social media can show us if more people are getting interested. Recently, more people have been talking about Bitcoin on Twitter, which might mean more people want to buy it.

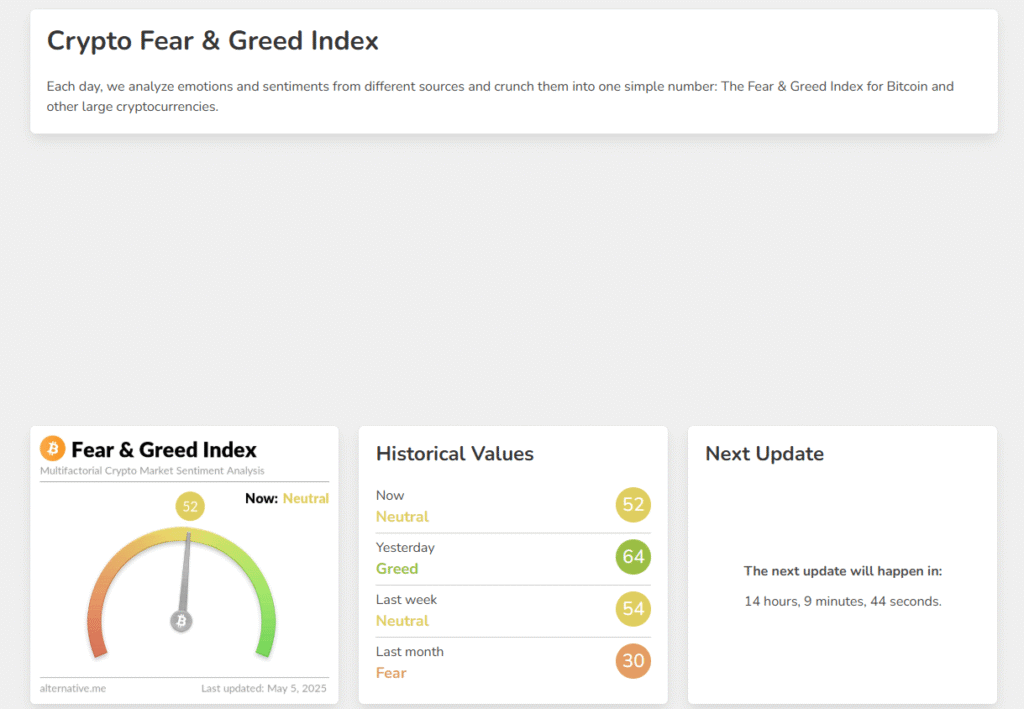

c) Fear and Greed Index

This index shows if people are too scared or too excited about Bitcoin. Right now, it shows people are getting more excited, but not too excited yet. This could mean the price might still go up more.

4. Institutional Adoption: Big Companies Buying Bitcoin

When big companies and investors start buying Bitcoin, it can make the price go up a lot. Here’s what to watch:

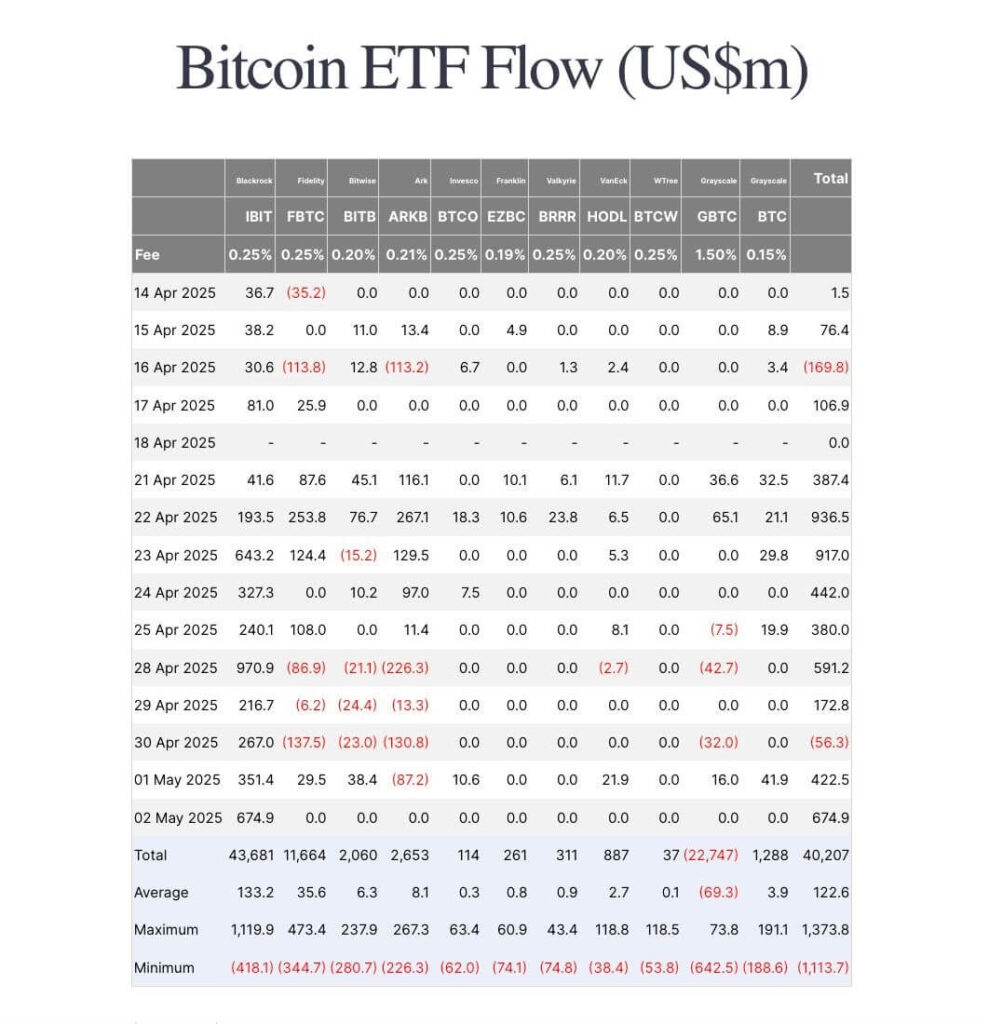

a) Bitcoin ETF Inflows and Outflows

Bitcoin ETFs are new ways for people to invest in Bitcoin without buying it directly. More money going into these ETFs could mean more people want to invest in Bitcoin, which might make the price go up.

b) Corporate Treasury Allocations

Some big companies are buying Bitcoin to keep as part of their savings. This shows they think Bitcoin is valuable and could make other companies want to buy Bitcoin too.

c) Institutional Investor Sentiment

What big investors think about Bitcoin can affect its price. Recently, more big investors have said they think Bitcoin is a good investment, which could mean more money might flow into Bitcoin.

It’s also important to know about cryptocurrency rules because they can change how much Bitcoin is worth and how many people use it.

5. Macroeconomic Factors: The Big Picture of Money

What’s happening in the world economy can affect Bitcoin’s price. Here are some things to watch:

a) Inflation Rates and Monetary Policy

When money loses value quickly (inflation) and banks keep interest rates low, more people might want to buy Bitcoin to protect their money. Right now, inflation is high in many countries, which could make Bitcoin more attractive.

b) Global Economic Uncertainty

When people are worried about the economy, they sometimes buy Bitcoin because they think it’s safer. There’s been a lot of uncertainty lately, which might make more people interested in Bitcoin.

c) Correlation with Traditional Markets

Sometimes Bitcoin’s price moves like the stock market, and sometimes it doesn’t. Lately, Bitcoin hasn’t been moving as much like stocks, which might make it more attractive to investors who want something different.

6. Supply Dynamics and Scarcity: How Much Bitcoin is Available

There will only ever be 21 million Bitcoins. This limited supply is important for its value:

a) Halving Events and Historical Impact

Every four years, the amount of new Bitcoin made gets cut in half. This has made the price go up in the past.

b) Circulating Supply vs. Total Supply

As we get closer to having all 21 million Bitcoins, each one might become more valuable. Over 19 million have been made so far, which means there’s not much left to make.

c) Lost Coins and True Scarcity

Some Bitcoins have been lost forever because people forgot their passwords or lost their keys. This makes Bitcoin even more scarce, which could make the price go up more.

7. Network Health and Technological Advancements: How Bitcoin is Getting Better

Bitcoin’s technology keeps improving, which can make it more valuable. Here’s what to watch:

a) Hash Rate and Mining Difficulty

The hash rate shows how much computing power is being used to keep Bitcoin secure. A high hash rate means Bitcoin is very secure, which is good for its value.

b) Lightning Network Adoption

The Lightning Network makes Bitcoin transactions faster and cheaper. More people using this could make Bitcoin more useful for everyday payments.

c) Taproot and Future Protocol Upgrades

Bitcoin keeps getting upgrades that make it work better. These improvements could make more people want to use Bitcoin.

FAQ: Common Questions About Bitcoin’s Path to a New ATH

| Question | Brief Answer | Confidence |

|---|---|---|

| When will Bitcoin reach its next all-time high? | It’s hard to say exactly, but it might happen in the next 1-2 years based on current trends. | Medium |

| What factors could prevent Bitcoin from reaching a new ATH? | Strict new rules, big security problems, or a bad global economy could stop Bitcoin from going up. | High |

| How does Bitcoin’s volatility affect its potential for a new ATH? | Bitcoin’s price changes a lot, which can make it go up fast, but also makes it risky. | High |

| Can technical analysis accurately predict Bitcoin’s price movements? | Technical analysis can help, but it’s best to use it along with other information to get a full picture. | Medium |

| How do geopolitical events impact Bitcoin’s price? | When there’s uncertainty in the world, more people might buy Bitcoin, which can make the price go up. | Medium |

Conclusion: Watching Bitcoin’s Journey to New Heights

We’ve looked at many things that could help Bitcoin reach a new all-time high price. From data on the blockchain to how people feel about Bitcoin, and from big companies buying it to improvements in its technology, there are many reasons to think Bitcoin’s price might go up. But remember, the cryptocurrency market can be very unpredictable, and prices can go down as well as up.

It’s important to keep learning about Bitcoin and cryptocurrencies if you want to invest in them. The market changes quickly, and new things are always happening. At CryptoSavvyHub, we’re here to help you understand what’s going on in the world of cryptocurrencies.

As you learn about cryptocurrencies, it’s also important to know about cryptocurrency scams to keep your money safe. Some people try to trick others in the cryptocurrency world, so you need to be careful and know how to protect yourself.

Whether Bitcoin reaches a new all-time high soon or not, staying informed is the best way to make good decisions. The world of cryptocurrencies is always changing, and there’s always something new to learn. By staying curious and informed, you’ll be ready for whatever happens next in the exciting world of Bitcoin and cryptocurrencies.