Meme coins have become a big deal in the crypto world. They’re exciting but risky. If you want to invest in them, you need to know how to check if they’re good or not. Let’s look at the important things to think about when you’re looking at meme coins.

Key Takeaways

| • Community engagement is really important for meme coins to do well | • How the coin’s money system works matters for long-term success |

| • It’s good if the project team is open about what they’re doing | • The total value and how easy it is to buy and sell are important |

| • Looking at price charts can help you decide when to buy or sell | • You need to be careful because meme coin prices can change a lot |

The Rise of Meme Coins: More Than Just Internet Jokes

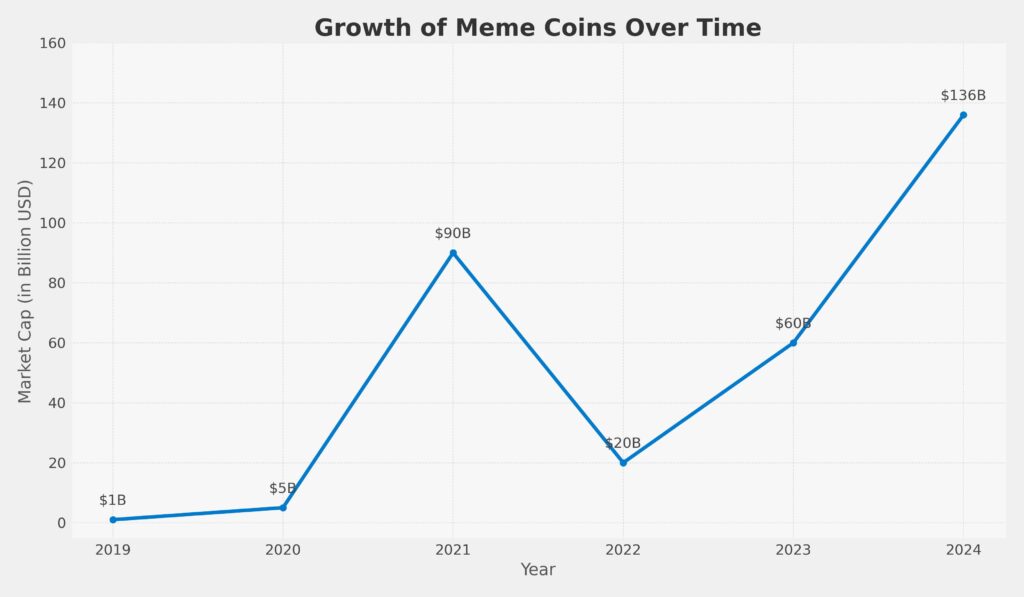

Meme coins started as a joke with Dogecoin in 2013, but now they’re a big part of cryptocurrency. Today, all the meme coins together are worth about $60-75 billion. This shows how internet culture can affect money and investing. It’s pretty amazing how these coins based on jokes have become so valuable.

Meme coins are different from regular cryptocurrencies because they get their value mostly from people talking about them and sharing them on social media. This makes them exciting but also risky for investors. Learning to look at these factors is key to making smart investment choices. You have to think about what people are saying online, how the coin is being advertised, and if it’s useful for anything.

Essential Factors for Evaluating Meme Coin Projects

Key Factors for Evaluating Meme Coin Projects

- Community engagement and size

- Project team transparency and reputation

- Tokenomics and distribution model

- Market capitalization and liquidity

- Potential use cases and long-term vision

- Social media presence and trending status

- Blockchain platform and technology used

- Risk of pump-and-dump schemes

- Regulatory compliance and legal considerations

- Meme relevance and viral potential

- Trading volume and price stability

- Partnerships and collaborations

- Development roadmap and milestones

- Security audits and smart contract reviews

- Community governance mechanisms

1. Community Engagement: The Heartbeat of Meme Coins

The strength of a meme coin lies in its community. When evaluating a project, look at:

- Size and activity of social media followers: A large, active following can indicate strong support and potential for growth.

- Engagement rates on platforms like Twitter and Discord: High engagement suggests a passionate community that can drive adoption and price action.

- Community sentiment and loyalty: Positive sentiment and loyal supporters can help a project weather market volatility.

A vibrant, active community can drive a meme coin’s success, while a lack of engagement might signal a dying project. Analyzing community metrics over time can provide insights into the project’s momentum and potential for viral growth.

2. Project Team and Transparency: Beyond the Memes

While meme coins are fun, serious investors should look beyond the jokes. Evaluate:

- The team’s background and experience: Look for members with relevant expertise in blockchain, finance, or marketing.

- Transparency in communication: Regular updates and open dialogue with the community can build trust.

- Regular updates and clear roadmaps: A well-defined plan for development and growth is crucial for long-term success.

Understanding the technology behind the coin can give you insights into its potential longevity and growth. Projects with strong technical foundations and innovative features may have an edge in the competitive meme coin landscape.

3. Tokenomics: The Foundation of Value

Tokenomics plays a crucial role in a meme coin’s potential. Consider:

Total Supply

The maximum number of tokens that will ever exist for the meme coin

Distribution Model

How tokens are allocated among developers, investors, and the community

Burning Mechanism

The process of permanently removing tokens from circulation to control supply

A well-designed tokenomics model can support long-term growth, while poor tokenomics might lead to rapid devaluation. Pay close attention to token distribution, vesting schedules for team and investor tokens, and any mechanisms designed to control inflation or incentivize holding.

4. Market Cap and Liquidity: Gauging Growth Potential

Understanding market cap and liquidity is crucial for assessing risk and potential returns:

- Compare market cap to established cryptocurrencies: This can help you gauge the relative size and potential for growth.

- Check daily trading volumes across exchanges: Higher volumes often indicate more liquidity and market interest.

- Assess liquidity to ensure you can exit positions if needed: Thin order books can lead to significant slippage when trading.

Remember, high liquidity often indicates a healthier market for the coin. However, be cautious of artificially inflated volumes or manipulated markets, which are not uncommon in the meme coin space.

Technical Analysis: A Tool for Timing

While meme coins are driven by sentiment, technical analysis can still be valuable:

- Use price charts to identify trends and patterns: Look for common formations like head and shoulders, triangles, or cup and handle patterns.

- Look for support and resistance levels: These can help identify potential entry and exit points.

- Consider volume indicators to confirm trends: Increasing volume during price movements can confirm trend strength.

Mastering technical analysis can help you make more informed decisions about entry and exit points. However, always remember that meme coins can be highly volatile and may not always follow traditional technical patterns due to their speculative nature.

Risk Management: Protecting Your Investment

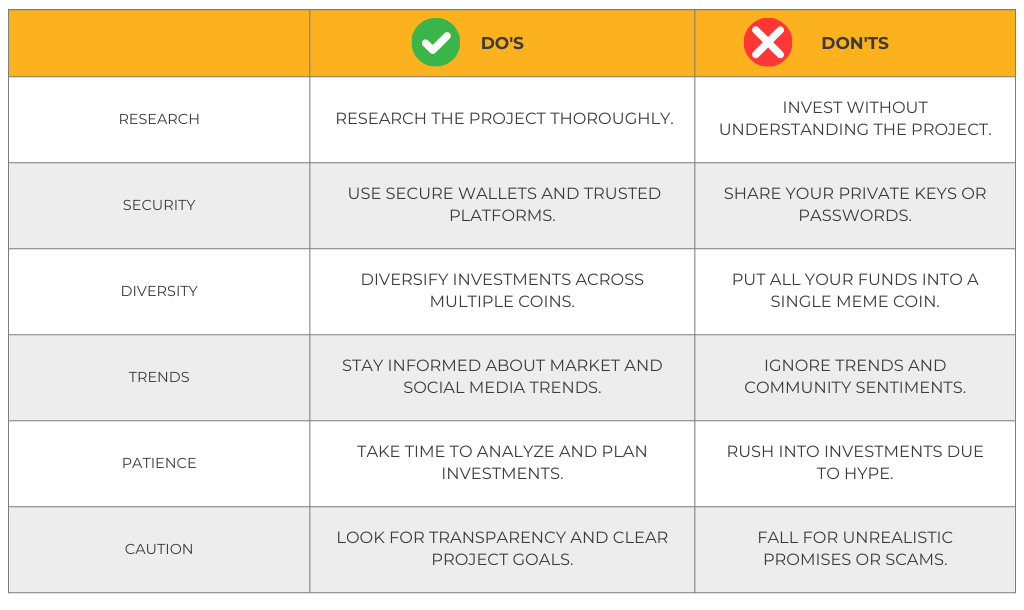

Investing in meme coins is high-risk, high-reward. Implement these strategies to manage risk:

- Only invest what you can afford to lose: Meme coins are highly speculative and can experience extreme price swings.

- Diversify your portfolio: Don’t put all your eggs in one meme coin basket. Spread your investments across different assets.

- Use stop-loss orders to limit potential losses: This can help protect your capital in case of sudden market downturns.

- Stay informed about market trends and news: Meme coins can be heavily influenced by social media trends and celebrity endorsements.

Remember, the meme coin market is highly volatile. Protecting your investment should be a top priority. Consider using hardware wallets for long-term storage and be cautious of phishing attempts or scams targeting meme coin investors.

Tools for Meme Coin Research

Equip yourself with these tools for thorough meme coin evaluation:

Analytics Platforms

Tools for tracking market data, price movements, and trading volumes

Community Forums

Platforms to gauge community sentiment and engagement

Crypto News Sites

Sources for staying informed about market trends and project updates

Use these resources to gather comprehensive information and stay ahead of market trends. Analytics platforms like CoinGecko or CoinMarketCap can provide valuable insights into market metrics, while community forums on Reddit or Discord can offer a pulse on community sentiment. Crypto news sites such as CoinDesk or Cointelegraph can keep you informed about broader market trends that may impact meme coins.

Conclusion: Making Informed Decisions in the Meme Coin Market

Evaluating meme coin projects requires a blend of technical analysis, community assessment, and risk management. By considering factors like community engagement, tokenomics, and market dynamics, you can make more informed investment decisions. The meme coin market offers unique opportunities, but it also comes with significant risks that must be carefully navigated.

Remember, the meme coin market is highly speculative. Always do your research, never invest more than you can afford to lose, and stay informed about the latest trends and regulations in the crypto space. The landscape can change rapidly, so maintaining a flexible and informed approach is crucial.

With careful evaluation and a balanced approach, you can navigate the exciting world of meme coins while minimizing risks. By combining technical analysis with an understanding of social dynamics and market sentiment, you can position yourself to potentially benefit from the next big meme coin trend. Happy investing, and may your memes be ever in your favor!