Introduction

Decentralized Finance (DeFi) lending is revolutionizing the way individuals can earn passive income by utilizing their crypto assets. Unlike traditional financial systems, DeFi lending operates without intermediaries, offering higher transparency, control, and rewards. By leveraging blockchain technology, this innovative ecosystem provides users with unique opportunities to grow their portfolios. However, to lend effectively and safely, users need to understand the risks and mechanics of the ecosystem.

Whether you’re a beginner or a seasoned investor, this guide will walk you through the essentials of DeFi lending, ensuring you maximize your returns while minimizing risks.

Key Takeaways

- What is DeFi Lending? A system where users lend crypto assets directly to borrowers via decentralized platforms, earning interest.

- Benefits: High interest rates, borderless access, and full control over assets.

- Risks: Smart contract vulnerabilities, market volatility, and platform-specific risks.

- Steps to Lend Safely: Choose the right platform, understand the terms, and diversify assets.

- Advanced Insights: The role of liquidity pools, yield farming, and governance tokens in DeFi lending.

What is DeFi Lending?

DeFi lending refers to the practice of loaning cryptocurrency assets to borrowers through decentralized platforms without intermediaries like banks. These platforms operate on blockchain technology, utilizing smart contracts to automate the process and ensure transparency.

For example, if you own stablecoins like USDT or cryptocurrencies like ETH, you can deposit them into a lending protocol to earn interest. Borrowers access these funds by providing collateral, ensuring the lender’s safety.

- Borrowing Mechanism: Borrowers must over-collateralize their loans, ensuring lenders’ funds remain secure even during market volatility.

- Popular Platforms: Trusted names include Aave, Compound, and MakerDAO.

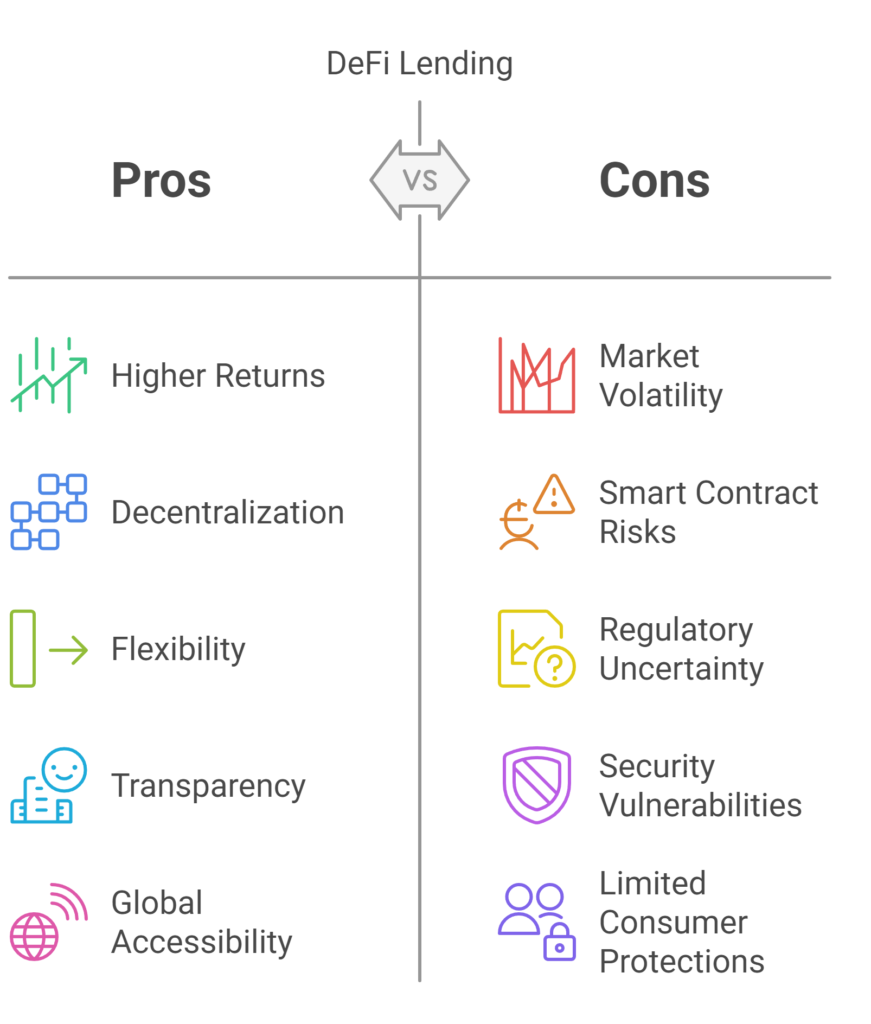

Benefits of DeFi Lending

- Higher Returns: Compared to traditional savings accounts, DeFi lending offers significantly higher annual percentage yields (APY).

- Decentralization: No intermediaries mean lower fees and direct transactions.

- Flexibility: Lenders can withdraw their funds or reinvest profits with minimal restrictions.

- Transparency: Blockchain technology ensures all transactions are visible and auditable.

- Global Accessibility: Anyone with a crypto wallet and internet connection can participate.

- Access to Liquidity Pools: Participate in liquidity pools to earn additional rewards from trading fees.

Risks and Challenges

While DeFi lending offers numerous benefits, it’s crucial to consider potential risks:

- Smart Contract Vulnerabilities: Bugs or exploits in the platform’s code can lead to loss of funds.

- Mitigation: Use platforms audited by reputable firms like CertiK or Trail of Bits.

- Market Volatility: The value of your collateral or lent assets can fluctuate significantly.

- Mitigation: Use stablecoins like USDC or DAI to minimize exposure to volatility.

- Regulatory Uncertainty: DeFi operates in a gray area of regulation, which could impact its long-term viability.

- Mitigation: Stay informed about local regulations before investing.

- Platform-Specific Risks: Not all DeFi platforms are reputable; scams and rug pulls are common in the space.

- Mitigation: Research platform reputation and Total Value Locked (TVL).

- Impermanent Loss: In liquidity pools, the value of assets can decrease relative to holding them independently.

- Mitigation: Research pool dynamics and choose stablecoin pairs.

How to Lend Crypto Assets Effectively and Safely

Step 1: Research and Choose a Platform

Top platforms include:

- Aave: Known for its diverse asset support and competitive interest rates.

- Compound: Offers an easy-to-use interface and supports multiple assets.

- Yearn.Finance: Automated strategies to optimize returns.

Tips: Choose platforms with robust audits, high TVL, and a proven track record.

Step 2: Set Up a Secure Wallet

- Opt for a non-custodial wallet like MetaMask or Trust Wallet for enhanced control.

- For added security, consider hardware wallets like Ledger or Trezor.

Step 3: Deposit Crypto Assets

- Fund your wallet.

- Connect it to your chosen DeFi platform.

- Select an asset to lend and approve the transaction.

Step 4: Monitor Your Investment

- Regularly check your earnings and the platform’s status.

- Use tools like Zapper or DeBank to track interest rates, collateral, and potential risks.

- Diversify your lending portfolio to minimize risks.

Advanced Insights for Experienced Investors

Yield Optimization

- Use yield farming strategies to maximize returns by leveraging multiple platforms.

- Example: Deposit USDT into a Uniswap pool and receive trading fee rewards plus governance tokens.

Governance Participation

- Platforms like Aave offer governance tokens (e.g., AAVE) that give holders voting power in platform decisions.

Cross-Chain Lending

- Explore cross-chain solutions like Wormhole to lend assets across different blockchain ecosystems.

Leverage Strategies

- Borrow against your crypto holdings to reinvest and maximize returns (with caution).

How to Mitigate Risks in DeFi Lending

- Start Small: Begin with a small amount to test the platform’s functionality and reliability.

- Diversify Assets: Lend multiple assets across different platforms to spread risk.

- Stay Informed: Follow crypto security updates and the latest news about the DeFi platform you’re using.

- Use Insurance Protocols: Platforms like Nexus Mutual offer protection against smart contract failures.

Top DeFi Lending Platforms in 2025

| Platform | Unique Features | Supported Assets | Average APY |

|---|---|---|---|

| Aave | Flash loans, multiple chain support | ETH, DAI, USDT, more | 2-8% |

| Compound | Simple interface, governance tokens | USDC, DAI, WBTC | 2-7% |

| MakerDAO | DAI-based stablecoin lending | ETH, BAT, USDC | 1-5% |

| Yearn.Finance | Automated yield optimization | YFI, USDT, ETH | Varies |

Conclusion

DeFi lending is an exciting opportunity for crypto enthusiasts to earn passive income and support the decentralized economy. By understanding the mechanics, evaluating risks, and applying effective strategies, you can maximize your earnings while keeping your assets secure.

Start your journey today by exploring top platforms like Aave or Compound and implementing the tips in this guide. For more insights on DeFi, yield farming, and crypto investments, visit cryptosavvyhub.com and stay ahead in the decentralized finance revolution!