The cryptocurrency investing world is changing, with Bitcoin ETFs leading the way. This big change affects both experienced crypto fans and regular investors. Let’s look at what this means for crypto investors and why it’s so important in finance.

Key Points: The Rise of Bitcoin ETFs

- Bitcoin ETFs let investors get involved with Bitcoin without owning it directly

- The SEC approved the first spot Bitcoin ETFs in January 2024

- ETFs are expected to increase market liquidity and attract institutional investors

- Investors should know about risks, including market ups and downs and unclear rules

- Bitcoin ETFs make investing easier and are managed by professionals

1. What Are Bitcoin ETFs?

Bitcoin ETFs are a new type of investment that connects regular investing with cryptocurrency. They’re funds that follow Bitcoin’s price, letting people invest in Bitcoin without actually owning it. Unlike normal ETFs that might track many stocks, Bitcoin ETFs just focus on Bitcoin’s price changes.

Important things about Bitcoin ETFs:

- You can buy and sell them on regular stock markets using normal brokerage accounts

- They’re backed by real Bitcoin, so they match Bitcoin’s market price

- They’re watched over by financial authorities, which helps protect investors

- Professional managers take care of the Bitcoin and trading

- You can invest in Bitcoin’s price without needing cryptocurrency wallets or exchanges

2. Why Bitcoin ETFs Matter

When the SEC (Securities and Exchange Commission) approved Bitcoin ETFs, it was a big deal. It shows that more people are accepting Bitcoin as a real investment. Bitcoin ETFs are changing investing in several important ways:

- More People Can Invest: Bitcoin ETFs make it easier for more people to invest, including those who didn’t want to deal with complicated cryptocurrency exchanges and wallets.

- Big Investors Getting Involved: Having regulated Bitcoin investments might make more big institutions invest, which could bring a lot of money into the crypto market.

- Better Market Flow: As more people invest in Bitcoin through ETFs, it might be easier to buy and sell, which could make prices more stable.

- Clearer Rules: The SEC approving Bitcoin ETFs helps make clearer rules for cryptocurrency investments, which could lead to more new crypto investment products.

- Growing Up: Adding Bitcoin to regular financial markets through ETFs shows that the cryptocurrency market is becoming more mature and accepted.

3. How Bitcoin ETFs Affect Market Liquidity

Market liquidity is important for any financial market to work well, including cryptocurrency. Bitcoin ETFs are expected to make the Bitcoin market more liquid. Here’s how:

- More Trading: Bitcoin ETFs give people a new way to invest in Bitcoin, which might increase how much Bitcoin is traded overall.

- Better Price Finding: When more people are trading, it’s easier to figure out the right price for Bitcoin quickly.

- Less Big Price Swings: While Bitcoin prices can change a lot, more liquidity from ETFs might help make these changes less extreme.

- Cheaper to Trade: As it gets easier to buy and sell Bitcoin, the cost of trading might go down.

- Price Matching Opportunities: Having Bitcoin ETFs alongside regular Bitcoin markets creates chances for traders to make money from price differences, which can help keep prices similar across different markets.

The improved liquidity from Bitcoin ETFs could make Bitcoin a more attractive and stable investment over time, possibly bringing in more investors and making it an even bigger part of the global financial system.

4. Benefits for Investors

Bitcoin ETFs offer many advantages for investors, making it easier to include cryptocurrency in their investments. Let’s look at these benefits:

- Easy to Invest: You can buy and sell Bitcoin ETF shares through your regular brokerage account, without needing to set up special cryptocurrency accounts.

- No Tech Hassle: You don’t need to understand complicated blockchain technology or how to store cryptocurrency safely.

- Better Security: ETF companies usually have strong security measures to protect the Bitcoin they hold, which might be safer than trying to keep Bitcoin secure yourself.

- Regulated: Bitcoin ETFs have to follow rules and report to authorities, which can make them more transparent and safer for investors than buying Bitcoin directly.

- Familiar Investment: For people used to investing in stocks, Bitcoin ETFs work in a similar way, making them easier to understand and manage.

- Possible Tax Benefits: Depending on where you live, investing in Bitcoin through an ETF might have tax advantages compared to owning Bitcoin directly.

- Easy to Diversify: Bitcoin ETFs let you easily add some cryptocurrency exposure to your investment mix alongside stocks and bonds.

- Professional Management: ETF managers handle all the complicated parts of buying, storing, and managing Bitcoin, so you don’t have to worry about it.

These benefits make Bitcoin ETFs an attractive option for many different types of investors, from people just starting to invest in cryptocurrency to big institutions looking for an easy way to add Bitcoin to their investments.

5. Potential Risks to Consider

While Bitcoin ETFs have many good points, it’s important to know about the risks too. Understanding these risks helps you make better investment decisions:

- Price Changes a Lot: Bitcoin’s price can go up and down quickly, and ETFs that track Bitcoin will do the same. You could gain or lose a lot of money in a short time.

- Unclear Rules: The rules for cryptocurrencies and related investments are still changing. Future rule changes could affect how Bitcoin ETFs work.

- Not Exact Tracking: Bitcoin ETFs might not perfectly match Bitcoin’s price because of fees and other costs. This means you might not get exactly the same returns as if you owned Bitcoin directly.

- Might Be Hard to Sell: During tough market times, it might be harder to buy or sell Bitcoin ETFs quickly or at the price you want.

- Depends on Other Companies: ETFs rely on various companies to work properly. If these companies have problems, it could affect the ETF.

- Technology Risks: If there are problems with the Bitcoin network itself, it could affect the value of Bitcoin and the ETF.

- Price Differences: Bitcoin ETFs might sometimes trade at prices that are higher or lower than the actual value of the Bitcoin they represent, especially when markets are very active or uncertain.

- New Investment: Since Bitcoin ETFs are new, we don’t know how well they’ll work in different market conditions over a long time.

It’s important to think carefully about these risks and how they fit with your overall investment plan and how much risk you’re comfortable with.

Bitcoin ETF Market Impact

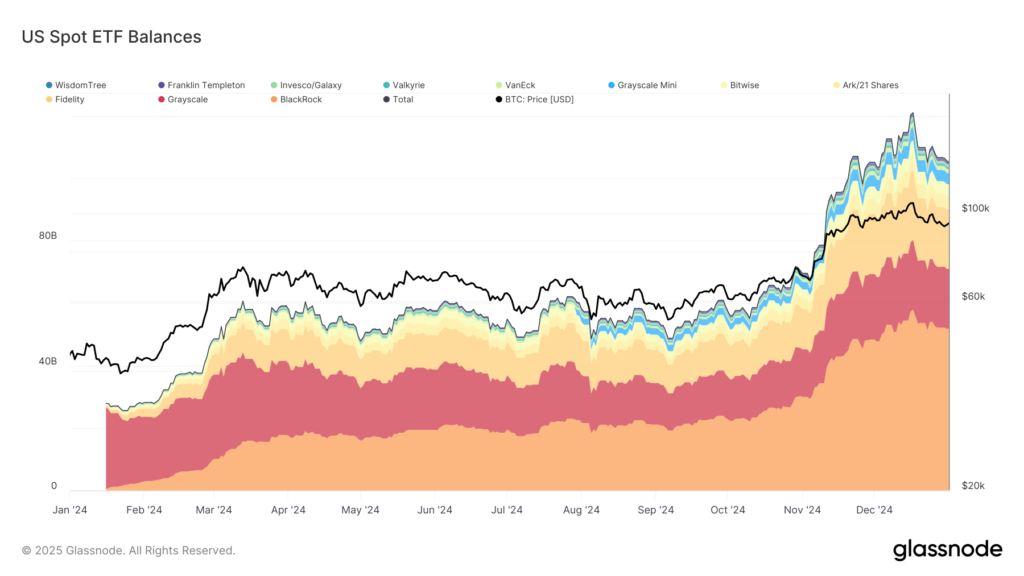

Fact: $IBIT, the #Bitcoin ETF by @BlackRock is the fastest growing ETF in history.

Institutional demand for #BTC assets just keeps growing and growing. #Crypto #DigitalGodl https://t.co/tK0MZOPoJA— OSL (@osldotcom) January 4, 2025

“Bitcoin ETFs are a big deal for cryptocurrency. They give investors an easy and regulated way to invest in Bitcoin without having to own it directly. This could help bring cryptocurrency and regular finance closer together, making it easier for more people to include digital assets in their investments.”— John Smith, Cryptocurrency Analyst

Easy to Invest

You can buy Bitcoin ETFs through regular brokerage accounts, without needing special cryptocurrency accounts

More Market Activity

ETFs can make the Bitcoin market more active, which might lead to more stable prices and easier trading

Expert Management

ETFs are run by experienced professionals who handle the tricky parts of buying and storing Bitcoin

Price Changes

Bitcoin’s price can change a lot, even in ETFs, so you need to be careful and think about how much risk you’re okay with

6. Impact on the Cryptocurrency Market

The introduction of Bitcoin ETFs is likely to have big effects on the whole cryptocurrency market:

- More People Using Cryptocurrency: Bitcoin ETFs make it easier for regular people and big investors to get involved with cryptocurrency.

- More Stable Prices: As more people invest in Bitcoin through ETFs, the price might become more stable over time.

- Effects on Other Cryptocurrencies: If Bitcoin ETFs are successful, we might see similar products for other cryptocurrencies.

- Connecting with Regular Finance: Bitcoin ETFs help bring cryptocurrency closer to the regular financial world, which could lead to new types of investments that mix both.

- Market Growing Up: The rules and professional management that come with ETFs could help make the cryptocurrency market more mature and trusted.

- Better Price Finding: Having Bitcoin ETFs in regulated markets might make it easier to figure out the right price for Bitcoin.

- More Research: As Bitcoin becomes easier to invest in through ETFs, more financial experts might study it, leading to better understanding of how it works as an investment.

These changes could really affect how the cryptocurrency market grows and becomes part of the bigger financial world.

7. How to Invest in Bitcoin ETFs

If you’re interested in investing in Bitcoin ETFs, here’s a guide to help you get started:

- Open a Brokerage Account: If you don’t have one, open an account with a good brokerage that offers Bitcoin ETFs. Many online brokers now have this option.

- Research Bitcoin ETFs: Look into different Bitcoin ETFs available to you. Think about:

- How much they charge in fees

- How much money they manage

- How easy they are to buy and sell

- How closely they follow Bitcoin’s price

- How good the fund manager is

- Decide How Much to Invest: Figure out how much money you want to put into Bitcoin ETFs. Think about your overall investment plan and how much risk you’re okay with.

- Buy the ETF: Once you’ve chosen a Bitcoin ETF, buy it through your brokerage account. You can usually choose to buy at the current price or set a specific price you’re willing to pay.

- Keep an Eye on Your Investment: Watch how your Bitcoin ETF investment is doing and stay informed about things that could affect its price.

- Adjust if Needed: Regularly check your investments and make changes if needed to keep the balance you want in your overall investment mix.

- Stay Informed: Keep learning about what’s happening in the cryptocurrency market, changes in rules, and new technology that could affect your Bitcoin ETF investment.

Remember, while Bitcoin ETFs make it easier to invest in Bitcoin, they still involve risks because cryptocurrency prices can change a lot. It’s a good idea to talk to a financial advisor before making big investment decisions, especially with new types of investments like cryptocurrencies.

8. The Future of Cryptocurrency ETFs

The successful start of Bitcoin ETFs is just the beginning of what could be a big change in cryptocurrency investments. As things develop, we might see:

- ETFs for Other Cryptocurrencies: After Bitcoin ETFs, we might see ETFs for other big cryptocurrencies like Ethereum, or ETFs that include a mix of different cryptocurrencies.

- Blockchain Technology ETFs: We might see funds that focus on companies working with blockchain technology, not just on cryptocurrencies themselves.

- Worldwide Adoption: As rules become clearer in different countries, we might see cryptocurrency ETFs approved in more places around the world.

- New Types of ETFs: There might be more complex ETF products, like ones that multiply Bitcoin’s price movements or bet against Bitcoin’s price.

- Mixing with Regular Finance: Cryptocurrency ETFs could lead to more ways of combining digital assets with traditional financial products.

- Easier Buying and Selling: As more people use cryptocurrency ETFs, it might become easier to buy and sell cryptocurrencies in general, which could make prices more stable.

- Changing Rules: How well Bitcoin ETFs work (or don’t work) will probably influence how governments make rules for cryptocurrency investments in the future.

- More Education: Having cryptocurrency ETFs in regular financial markets could help more people learn about and understand digital assets.

These possible changes show how quickly the cryptocurrency investment world is changing and how digital assets are becoming more connected with traditional finance. As things keep changing, investors and people in the industry should stay informed and be ready to adapt to new opportunities and challenges.

Conclusion

Bitcoin ETFs are a big deal in cryptocurrency investing. They make it easier for regular people and big investors to put money into Bitcoin. This could change how people invest in cryptocurrencies and how widely they’re used.

Bitcoin ETFs have many good points. They’re easier to use, you don’t need to know as much about technology, and they follow more rules that protect investors. But it’s important to remember that they still have risks, just like Bitcoin itself, because cryptocurrency prices can change a lot.

As more cryptocurrency ETFs are created, we’ll probably see new ideas, clearer rules, and the cryptocurrency market becoming more mature. This could affect not just Bitcoin, but how digital money fits into the global financial system.

If you’re thinking about investing in Bitcoin ETFs, it’s important to do your research, think about your financial goals and how much risk you’re okay with, and stay up to date with what’s happening in the market. Bitcoin ETFs are an exciting new way to invest in cryptocurrency, but they should be part of a bigger investment plan, not the only thing you invest in.

We’re still in the early stages of bringing cryptocurrency into mainstream finance, and Bitcoin ETFs are an important step. As we move forward, the mix of traditional financial tools and digital assets will keep shaping how people invest, creating both opportunities and challenges for investors and people working in finance.

To stay ahead in this fast-changing world, investors should keep learning about cryptocurrency markets and investment products. For more information on how to start investing in cryptocurrency, check out our beginner’s guide to cryptocurrency investing.