Introduction

Decentralized Finance (DeFi) has revolutionized the cryptocurrency ecosystem, offering innovative ways for investors to grow their wealth. One of the most popular methods is staking, a mechanism that allows users to earn passive income while contributing to the security and efficiency of blockchain networks. In this article, we delve into the world of staking, exploring its benefits, risks, and how you can get started.

Key Takeaways

- Staking involves locking up cryptocurrency in a blockchain network to earn rewards.

- It is a fundamental part of Proof-of-Stake (PoS) and similar consensus mechanisms.

- Staking offers a way to generate passive income with varying degrees of risk and reward.

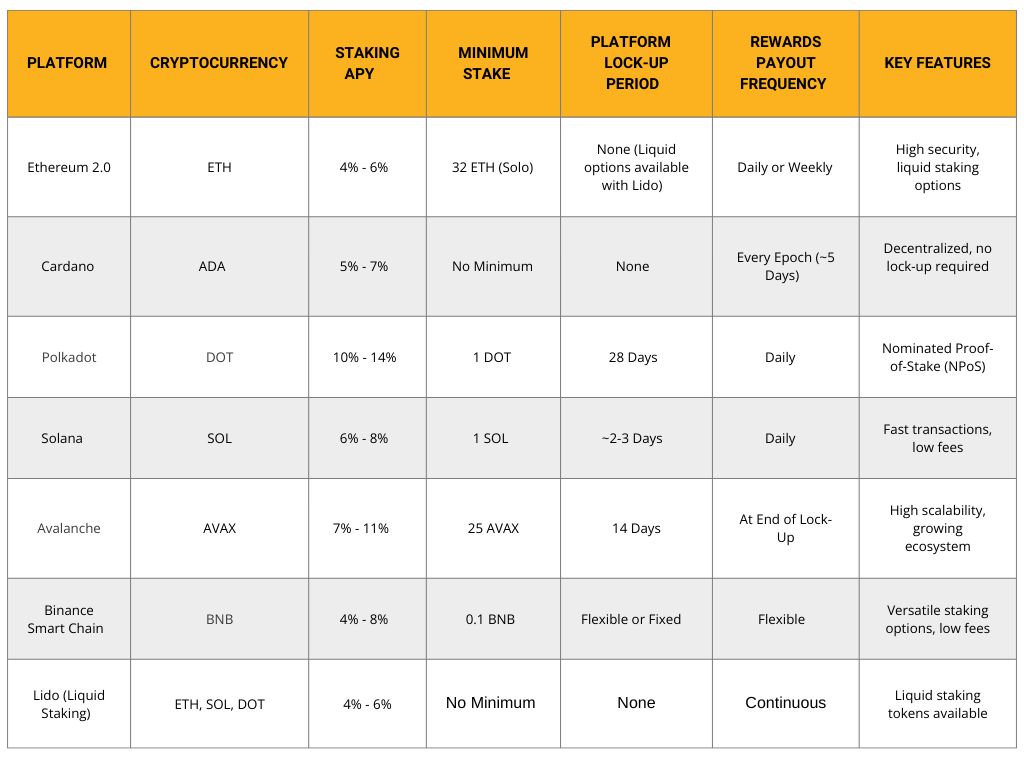

- Popular platforms for staking include Ethereum, Cardano, Solana, and Binance Smart Chain.

- Understanding the risks and selecting the right platform is critical for success.

What Is Staking in DeFi?

Staking is the process of committing your cryptocurrency to support a blockchain network’s operations. It’s an integral feature of PoS and Delegated Proof-of-Stake (DPoS) networks, which rely on validators instead of miners to verify transactions and maintain the blockchain’s integrity.

How Does Staking Work?

In a PoS network, participants lock a specific amount of cryptocurrency in a wallet to become validators. Validators are responsible for creating new blocks, verifying transactions, and ensuring network security. In return, they receive rewards, often in the form of additional cryptocurrency.

For instance, staking Ethereum on the Ethereum 2.0 network requires locking up ETH in a staking contract, which helps validate transactions and secures the network’s transition to PoS.

Benefits of Staking

Passive Income

Staking allows you to earn additional cryptocurrency without actively trading. It’s a great way to make your crypto holdings work for you.

Network Participation

By staking, you contribute to the security and efficiency of the blockchain, making the ecosystem more robust.

Lower Barriers to Entry

Compared to mining, staking typically requires less technical expertise and hardware investment.

Potential for High Returns

Some networks offer attractive Annual Percentage Yields (APYs) for stakers, making it a lucrative option for long-term investors.

Risks and Challenges of Staking

Volatility

Cryptocurrency prices are notoriously volatile. Even if you earn rewards, a significant drop in the token’s value can offset your gains.

Lock-Up Periods

Some staking platforms require you to lock your funds for a specified period, during which you cannot withdraw your assets.

Slashing Risks

In certain networks, validators can lose a portion of their staked funds as a penalty for dishonest or inefficient behavior.

Platform Risks

The security of the staking platform itself is critical. Hacks or technical failures can lead to losses.

How to Get Started with Staking

- Choose the Right Platform Research platforms that support staking for your preferred cryptocurrency. Popular options include:

- Ethereum 2.0

- Cardano (ADA)

- Polkadot (DOT)

- Binance Smart Chain (BSC)

- Set Up a Wallet Ensure you have a compatible crypto wallet. For example, MetaMask or Ledger for Ethereum staking.

- Fund Your Wallet Purchase or transfer the required cryptocurrency to your wallet.

- Select a Validator or Pool Decide whether to stake independently or join a staking pool. Pools are ideal for small investors as they combine resources to increase the chances of earning rewards.

- Start Staking Follow the platform’s instructions to lock your funds and begin earning rewards.

Advanced Insights: Liquid Staking

Liquid staking is an emerging trend that solves the issue of locked funds. With liquid staking, you receive a derivative token representing your staked assets. These tokens can be traded or used in other DeFi protocols, enhancing liquidity and flexibility.

For example, platforms like Lido offer liquid staking solutions for Ethereum and other PoS networks, enabling users to earn rewards while maintaining access to their funds.

Conclusion

Staking in DeFi is an exciting opportunity for crypto enthusiasts to generate passive income while supporting blockchain networks. By understanding the benefits, risks, and best practices, you can make informed decisions and maximize your returns.

Ready to dive deeper into the world of DeFi? Explore our comprehensive guides and tutorials on CryptoSavvyHub to enhance your knowledge and investment strategies.

FAQs

1. What is the minimum amount required for staking?

2. Can I unstake my cryptocurrency anytime?

It depends on the platform. Some have flexible staking, while others enforce lock-up periods.

3. Are staking rewards taxable?

Yes, in many jurisdictions, staking rewards are considered taxable income. Consult a tax professional for guidance.

4. What’s the difference between staking and yield farming?

Staking secures a network, while yield farming involves providing liquidity to DeFi protocols for rewards.